Just how do I pick the most effective life insurance policy for my loved ones? Universal life insurance is a type of long enduring life policy with even more overall flexibility than any kind of other type of plan.

What Is a Universal Life Insurance Policy?

Common life insurance coverage is a kind of long-term term life insurance, offering both a death benefit along with a cash value element.

Your policy will stay in effect so long as you pay your premiums or stay alive. There are 3 types of coverage: listed universal life, variable common life, and guaranteed common life. Policyholders have a particular amount of flexibility compared to various other long-term life insurance coverage policies in that you could lessen your premium obligations or swap out the death advantage amount.

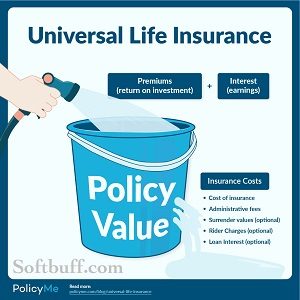

Plus, the cash value component offers more potential to earn more interest– on the flip side, the worth can go down over time. Specifically, the money value component earns interest devoted to market bourse interest, or for a few kinds of universal policies, a mortgage loan that’s linked with a market index.

Whatever you earn increases your cash value, helping you pay your premium. Decreasing your monthly obligations can be useful if your financial situation changes. Keep in mind that doing so will eat up your cash value– if there is not enough you will need to make up the difference or else your policy will lapse.

What Is Indexed Universal Life Insurance?

Found universal term life insurance( IUL) is a method to earn interest that’s mounted on the performance of index funds just like the S&p. You may choose to earn any part of your cash in a fixed rate account.

What Is Variable Universal Life Insurance?

Varying universal term life insurance( VUL) was created to give policyholders an option about how precisely to consider a posture the money associated with the coverage. Stocks, bonds, and common funds are available- you can also commit to multiple accounts.

What Is Guaranteed Universal Life Insurance?

Likely universal life insurance coverage( GUL) is a form of the universal policy providing you with guaranteed death gain and premiums that stay through the policy’s life. Jul procedures are often included under over time life insurance umbrella, however, they usually have a finish date that is selected in the time purchase. Policyholders typically choose an advanced age- 97, 102, etc. The insurance plan will remain active until that point. A GUL policy could have little if any cash value when compared with other ongoing life policies.

How Does Universal Life Insurance Work?

Once you keep paying your repayments in your universal life insurance coverage, you’ll knowledge cash value growth above time. Depending on the insurer as well as the policy you eventually go along with, you may well need to pay one particular upfront premium payment as well as a fixed monthly high grade.

As long as the bucks in your cash importance remain in your insurance plan, your funds will continue to experience income a considerable tax-free expansion, though the value of the accumulated dollar could go downwards, determined by the kind of universal policy, should your assets underperform. However, in the event you distance yourself from money, you should include cover taxes as well as your death benefit can easily decrease.

If you come to a decision to terminate your insurance plan, you can keep just about all of the accumulated cash value. One particular exception is if you were to borrow from your cash value. The money amount is not taxable should you pay back the full amount while the policy is still effective.

If the amount you borrow( including interest) is higher than the fund’s value, your insurance plan might lapse. Once you expire as well as your insurance coverage remains active, the beneficiaries will simply find the death benefit– the insurance provider can keep any funds around this amount. Beneficiaries typically acquire a single tax a considerable free payment, or every month or yearly installments.

A lot of insurers offer annuities while an additional option– these are typically contracts where the insurer agrees to shell out the beneficiary a sole-time payment as well as periodic payments for some predetermined length of time.

Compare Term, Whole, and Universal Life Insurance

Universal Life vs. Whole Life Insurance

|

UNIVERSAL LIFE INSURANCE |

WHOLE LIFE INSURANCE |

|---|---|

|

|

|

|

Either universal and experience of living are long-term policies, offering both a death benefit and cash value component. When either type of a life insurance policy can help you use your policy as an investment vehicle, the important significant difference lies in the way the cash value increases over time.

An entire life policy provides a likely fixed interest rate, and your premium amount is the same. Plus, your death benefit amount is guaranteed. For all these reasons, whole-life payments are usually more expensive than universal life procedures. Universal life, on the other hand, does not warranty returns on your money value because the interest rate fluctuates based on the type of investment chosen by your insurance firm.

Should your investments underperform, your accumulated cash value will go down, which could lead to higher payments. Of course, your assets in your universal life insurance policy could service well, potentially better than what whole life coverage can provide, contributing to lower premiums. Either policy allows you to borrow against your money value or surrender your policy. Undertaking so will reduce your loss benefit paid out to your beneficiaries.

Common life plans cost significantly more than term life insurance as a result of the cash value component. Both common and whole life cost more than term because part of the rates goes towards the cash value portion. “You in excess of it worthy of the buying price of coverage in earlier years to amass profit the policy”, states Glenn J. Downing, CFP, Principal at CameronDowning.

Inside the old age, you underpay the price tag on insurance, and the amount of money value subsidizes the”. For all kinds of term life insurance, your premium obligations will count on several factors such as your actual age, health, and lifestyle. For example, say you are a 20- 12 months- old male who does not drink or smoke cigarettes, looking to buy a term life policy with a$ 100, 000 loss of life benefit.

Generally, your good quality will soon be much less than a 50- year- old fart who has been smoking regularly for the last twenty years. That’s because the insurer views the 50- year- old as having a greater health risk, and for that reason a greater coverage premium.

However, for common life insurance, premiums will also vary depending on how well the opportunities in the cash value component fare. If you accumulate a big amount of cash value, you can use some of this amount towards your premiums.